This article first appeared in the December 2022 issue of Benefits and Pensions Monitor.

The need to mobilize capital to address the consequences of climate change, global health challenges, and social inequality has never been greater.

Most people are now familiar with the term ESG (environmental, social, and governance) and many investment firms are pitching ESG investing strategies. However, ESG is not truly an investing strategy; rather, it is a framework for assessing a company’s practices and past performance around sustainability and how those practices may help or hinder a company in generating financial returns to investors. In addition, the work that the newly-created International Sustainability Standards Board (ISSB) is doing to set IFRS (International Financial Reporting Standards) Sustainability Disclosure Standards will help harmonize reporting standards. However, additional reporting will not by itself help address the challenges facing us today.

That’s where impact investing comes in. Impact investments are made with the intention to generate positive and measurable social and environmental impact alongside a financial return. Impact investing is a tool that can help us tackle some of the most complex issues facing society today. It is a forward-looking mandate to generate risk-adjusted market returns while avoiding or restoring environmental damage and generating positive outcomes for society. Intractable challenges, seen through an impact lens, become solvable; opportunities are pursued with social and environmental systems in balance.

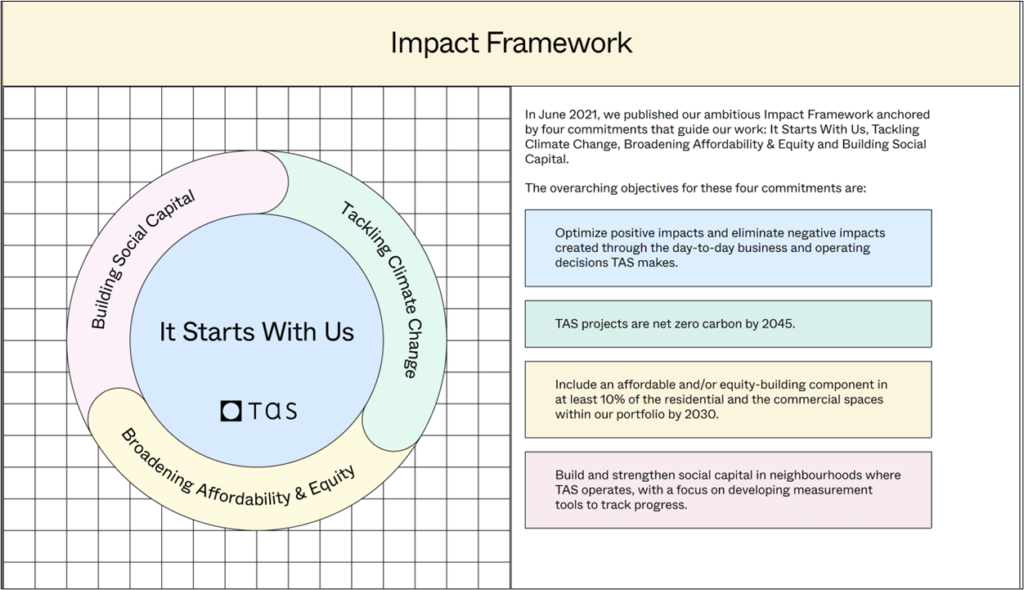

TAS is proud to be at the forefront of real estate investors and developers focusing on impact investing.

What Does A Good Impact Strategy Entail?

There is growing recognition that the singular focus of businesses and investors on generating financial profits and shareholder returns in the short run is damaging in the long run. Historically, businesses and investors have failed to internalize social and environmental costs. By contrast, when we take a systems view, we no longer see business’ so-called externalities as immaterial. Successful, sustainable businesses create long-term value, operating in a way that addresses social equity and functions within the carrying capacity of the earth while generating financial return.

While an impact investment strategy may be thematic – think tackling climate change; finding ways for tenants to share in the value created by having them in a building; funding female and minority-owned businesses – a good strategy should be comprehensive and look beyond the narrow focus of the core positive impact of a business model, product, or service. The concept of double materiality should be applied; consider risks and opportunities to the investment and the negative and positive impact the investment can have on society and the planet.

The Impact Management Platform, a collaboration between leading providers of public good standards and guidance for managing sustainability impacts, provides practical tools to contextualize impact across five dimensions (what, who, how much, contribution, and risk). The Global Impact Investor Network (GIIN), a global membership-based organization championing impact investing, hosts the IRIS+ catalogue of impact indicators, helping to standardize impact measurement wherever practicable.

Impact measurement should be based on a clear theory of change for each strategic priority using the lens of double materiality and needs to be integrated into a day-to-day approach of a business. Output indicators quantify efforts across operational and product/service delivery, while the five dimensions of the impact management platform can be used to contextualize the impact achieved. Impact performance data should be operationally relevant, providing insight into how to better integrate impact into the value proposition of the business.

What Value Does Impact Investing Bring?

Applying the impact lens to an investment strategy ushers in a systems view of the world ‒ one that identifies risks and opportunities for value creation. It shifts capital to align with the needs of society and to work within the carrying capacity of our planet. More importantly, capital deployed with this lens can reverse course on the destruction of the environment and address structure inequities that limit the potential of millions of people.

This shift delivers triple bottom-line returns. In fact, evidence has shown that impact investment portfolios are providing competitive risk-adjusted returns. In the last GIIN Impact Investor Survey, 88 per cent of impact investing respondents reported meeting or exceeding their financial expectations and over two-thirds of respondents (67 per cent) sought risk-adjusted, market-rate returns for their assets. This confirms that while some impact investors, particularly those seeking to deploy philanthropic assets, may do so as an efficient way to achieve impact objectives, most investors applying an impact lens do not tradeoff between impact and financial performance and instead seek and achieve risk-adjusted market-rate returns alongside measurable positive impact. Simply stated, impact investing is an evolved lens on solid business fundamentals.

At TAS, we are optimists. While we see the challenge ahead of us, we also see great possibilities. In October 2022, the GIIN estimated the size of the worldwide impact investing market was US$1.164 trillion, marking the first time that the estimate has topped the US$1 trillion mark. While positive, we need to mobilize trillions more to address the world’s pressing challenges posed by growing inequality and the numerous environmental crises ‒ from climate change to habitat destruction. Set against a backdrop of ongoing pandemic disruptions, geopolitical tensions, and unsteady world financial markets, the need has never been greater to shift the power of capital towards solving these global challenges.

Impact investing is catalyzing that shift and showing the power of combining purpose and profit.

Written by Mazyar Mortazavi, President & CEO

and Kate Murray, Director, Impact Strategy & Measurement