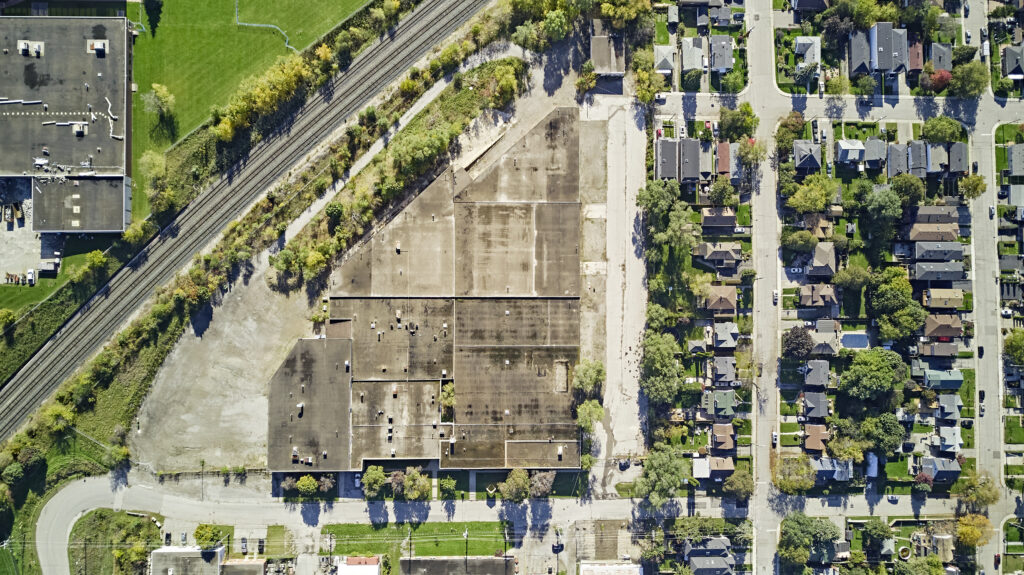

Repositioning real estate is the driving idea behind TAS’s Community Hub Strategy. Since 2021, we have been investing in urban industrial buildings across the GTHA and leading their transformation from traditional warehouses to various flexible commercial/industrial uses including small businesses and social enterprises.

On April 15th, TAS co-hosted a workshop with the Toronto Region Board of Trade called: Reimagine, Renew & Repurpose: The Art of Real Estate Repositioning. Our Chief Investment Officer Khan Tran, CPA, CA CFA, and Joseph Ogilvie, PMP, LEED AP from Schulich School of Business – York University led a candid discussion on the challenges with building conversions and the opportunities for achieving favorable ROIs AND achieving environmental and social impacts.

Here are some key takeaways from the workshop:

1. Take advantage of cap rate spreads: Repositioning works best when you can leverage cap rate spreads between 300-400bps between current and contemplated uses. For example, in Canada, the 2023 Q4 cap rate for suburban office was 8.0-8.74%, but multifamily was 3.35-4.40%, meaning the switch from suburban to multi-family would result in about 4% cap rate increase.

2. The increased value from a building conversion can be used to deliver social and environmental impact: The goal of repositioning is not just to maximize financial return on investment. The increase in value from a conversion project is what allows TAS to deliver on social and environmental initiatives in our Community Hubs portfolio. For example, the increased value we generate from the conversion of old urban industrial buildings allows us to offer below-market rents to impact-aligned tenants. The partnerships created with these tenancies, in turn, create value for market-rate tenants by offering a community benefit for their employees that aligns with corporate values and supports employee retention efforts. Further, this value creation also generates the capital needed to deliver on environmental initiatives, such as adding LED lighting, upgrading old HVAC systems, and installation of alternative energy solutions.

3. Get creative with the capital stack – In spite of market challenges, developers are having to be more creative with how they finance conversion projects. Though conventional lenders can look more favorably on projects that prioritize ESG, looking to other tranches of unconventional capital can help to derisk conversion opportunities. Examples can include: grants, incentives, rebates, heritage and other relevant tax credits, ESG-oriented equity & debt (CIB, CMHC, other), Impact-oriented equity & debt, innovation funding (TAF investment, catalyst funds etc).

4. Prioritize the stickiness of adaptive reuse projects: Successful buildings are lively, meaningful destinations that foster a sense of community and belonging. When leading an adaptive reuse project, developers need to consider how to infuse spaces with authenticity and create an ambiance that resonates with its users. Accessibility, atmosphere, diverse activities, and the ability to keep people coming back – are key success factors.

5. Green retrofits can create revenue premiums: Repositioning projects require significant upfront investments, for things like retrofits and mechanical upgrades. Premiums are needed to offset the IRR depressing effects of these early costs. Not only is investing in green buildings reducing CO2 emissions, it can also create the opportunity for targeted revenue premiums by attracting tenants and businesses who want to work in a green building and demonstrate their commitment to CO2 reduction as organizations.

To learn more about TAS’s Community Hub Strategy, get in touch info@tasimpact.ca