The project will deliver positive social and environmental impact and help make Hamilton’s downtown core even more vibrant.

HAMILTON, Friday, November 19, 2021 – Today, TAS announced the expansion of its value-add portfolio with the recent acquisition of the historic Coppley Building on York Boulevard in downtown Hamilton by its TAS LP 3 fund. TAS will lead the adaptive reuse of this iconic property in collaboration with key partners, notably including Hamilton Community Foundation, who are investors in the project and will be an anchor tenant.

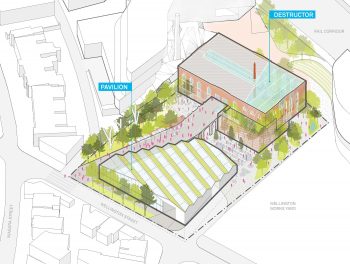

TAS plans to restore the Coppley Building’s original character and footprint and transform it into a community-serving hub that will include a lively mix of commercial uses and tenants. TAS has already started engaging local Hamiltonians and hiring key consultants and trades. Restoration and renovation work is expected to begin in mid-2022 and TAS plans to start welcoming new tenants in mid-2023.

“At TAS, we believe that real estate development is a tool that can be used to deliver both positive impact for communities and strong financial returns for investors,” said Mazyar Mortazavi, President & CEO of TAS. “This is our first project in Hamilton, and we’re excited to learn from and partner with local community members.”

As a Future-Fit Pioneer and Certified B Corporation, TAS will leverage the transformation of the Coppley Building to drive both positive social and environmental impact. Its team is currently exploring a series of related innovations, such as:

- Green and smart technologies

- Accessible design

- Offering subsidized below-market rents to some tenants

- Developing new models that will help some tenants build equity and participate in the value the project generates

“As a founding investor and anchor tenant, we are thrilled to play a role in the revitalization of this iconic property,” said Terry Cooke, President & CEO of Hamilton Community Foundation. “For over 165 years, this landmark has meant so much to the vibrancy of the core and the lives of many Hamiltonians who worked here, and we look forward to partnering with TAS to deliver a new hub for commercial and social activity downtown.”

Vancity Community Investment Bank (VCIB), an established partner of both TAS and Hamilton Community Foundation, has provided financing for the project.

“As an impact-driven bank, VCIB is thrilled to partner with an organization like TAS that puts community and environment at the forefront of its developments,” said Trish Nixon, Managing Director of Commercial Impact Banking, VCIB. “The Coppley project is a great example of this approach, and we’re pleased to provide financing to help bring it to life.”

“We are thrilled to partner with Hamilton Community Foundation and Vancity Community Investment Bank, who are both established leaders in Canada’s impact investing landscape,” said Khan Tran, Chief Investment Officer, TAS. “We look forward to working together to create value and deliver positive impact within downtown Hamilton.”

-30-

ABOUT TAS

TAS is an unconventional impact company that promotes connected neighbourhoods and, caring, committed communities. As a Future-Fit Pioneer and a Certified B Corporation, TAS is an industry leader in impact development with an active pipeline and portfolio totaling more than six million square feet across 17 properties throughout the Greater Toronto and Hamilton Area. TAS focuses on tackling climate change, expanding affordability and equity, and building social capital to create neighbourhoods – and ultimately cities – where people can thrive and belong. TAS partners with investors to shape and amplify this vision . Join in by visiting tasimpact.ca and following our journey on LinkedIn, Instagram, and Twitter.

ABOUT TAS LP3

TAS announced the closing of its third diversified real estate fund, TAS LP 3, in May 2021. TAS raised in excess of $100 million of equity commitments for this closed-end fund, which will be deployed to expand the firm’s existing Greater Toronto and Hamilton Area (GTHA) pipeline and deliver social and environmental impacts with and for communities through development and value-add projects.

ABOUT HAMILTON COMMUNITY FOUNDATION

Hamilton Community Foundation has been working to drive positive change in Hamilton since 1954. HCF does this by helping people give in a way that has meaning to them and impact in the community, providing grants and financing to charitable organizations and initiatives and bringing people together to address priority issues that affect Hamiltonians. Last year HCF gave 854 grants to 321 charities, totalling $12.9 million. Its assets include $8.0 million in loans to local charities and $23.6 million in impact investments that generate both a financial and a social and/or environmental return. hamiltoncommunityfoundation.ca/

ABOUT VANCITY COMMUNITY INVESTMENT BANK

VCIB is an Ontario-based schedule 1 federally chartered bank and a subsidiary of Vancity Credit Union. As Canada’s first values-driven bank, VCIB provides banking, investing, and financing solutions, to help purpose-driven businesses and organizations thrive, grow, and foster change. Additionally, VCIB offers specialized financing solutions for social purpose real estate and clean energy projects. VCIB is a certified B Corporation and a member of the Global Alliance for Banking on Values. For more information, visit vcib.ca, tweet us at @BankVancity and connect with us on LinkedIn. vancitycommunityinvestmentbank.ca/

For further information:

Camara Miller, Manager, Brand & Communications, TAS

camara.miller@tasimpact.ca